What is the importance of simulating credit before engaging in a contract?

To simulate a loan is essential to ensure that you are making the right financing choice and avoid compromising your financial health. Understand better, next.

To simulate a loan is essential to ensure that you are making the right financing choice and avoid compromising your financial health. Understand better, next.

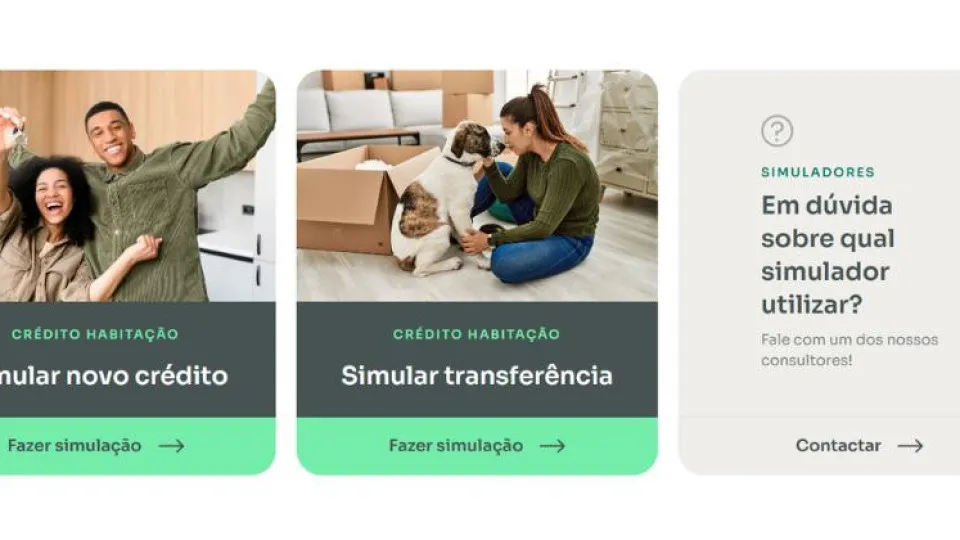

Looking to take out a mortgage? Transfer your credit to another bank? Now it's easier: Get to know the free online simulators of Poupança no Minuto, which show you the best credit proposal for you in one minute.

Found your perfect home and need to hire a housing credit? Or are you stuck with Euribor and want to change the conditions of your current housing credit? Poupança no Minuto offers two simulators to find the ideal solutions for you.

The public guarantee for home purchase aimed at young people will not be able to cover a couple of two young people, if one is over 35 years old.

Vai comprar casa ou já tem crédito e quer perceber melhor como se calcula o valor que paga todos os meses? Neste artigo, explicamos como calcular a prestação do crédito habitação, quais os fatores que a influenciam e como fazer simulações com confiança.

Está a pensar comprar casa e não sabe quanto pode pedir de crédito habitação? Neste artigo, explicamos os critérios usados pelos bancos, como fazer o cálculo e que fatores podem aumentar ou reduzir o valor aprovado.

To request a housing loan simulation, it is necessary to provide some information to understand how much you may have to pay. These simulations are indicative, but can help you evaluate whether it is feasible to apply for a housing loan from banks or through a credit intermediary.

Are you going to buy a property that needs renovations? Or just improve a house you already own? In any case, there is a solution: personal credit for works. It is a simple financing that can be contracted digitally. Learn how it works.

For those who have contracted the three-month Euribor on their variable rate mortgage, in December and January they will begin to feel a slight reduction in the monthly installment they pay. This is because interest rates have already reached the maximum limit. Understand better when each term begins to impact the house payment.

Is it possible to start dealing with home loan before choosing the property? The answer is yes! Find out how, right away.

If you are looking for a housing loan, know that it is possible to find the best on the market for you, without any hassle or cost. Understand how a credit intermediary like Poupança no Minuto can help you.

When buying a house with a mortgage, you may come across confusing terms. If you have started the process and the bank has given you a sheet called FINE, understand its purpose and how to analyze it.

The effort rate is one of the concepts in mortgage credit. In short, the effort rate assesses whether you have the ability to meet the installments of a loan. But what does this concept mean and how is it calculated?

When buying a house through a bank loan, you may be faced with complex mortgage credit language. Such as the acronyms related to interest rates, APR and APR. So, what do they mean and what do they represent?

The interest rate you choose for your home loan has a direct impact on the amount you will pay for the monthly installment. You can choose between a fixed, variable, or mixed rate. But what does each concept mean, how does it work, and how does it impact the loan?